If independence is not required in a consulting engagement, our valuation professional can offer consultation regarding a potential acquisition target or to assist as a general question regarding the value of a business interest for possible discussions with owners or prospective owners. In addition, if there is a need for financing a business purchase and there is a need to prepare funding documents to support the acquisition and the work does not require independence, a consulting engagement can be developed. However, if there is a need for an independent appraisal, the appraiser cannot perform both consulting and appraisal for the same assignment.

Whether, the assignment is an appraisal or consulting engagement, professional competence is critically important, and we assure each client that we have the necessary skills to perform each engagement. The team at Houston Valuation & Appraisal has years of experience in strategic consulting to uncover areas of strength that need to be enhanced and weaknesses that need to be corrected through aggressive intervention. Understanding the competitive landscape can deliver strong value multiples though top-to-bottom analysis, planning and execution.

We have advised clients from diverse industries and have served as trusted advisors to assist owners in understanding the critical factors in determining where and how value is created.

Some of that value is based on the businesses’ ability to extract surplus margins relative to those of its competitors. For example, applying the work from Dr. Albert Humphrey of the Stanford Research Institute in using a SWOT analysis (strengths, weaknesses, opportunities and threats) we’re able to determine how to position a business to become more competitive and consequently, more valuable to the owners and even prospective buyers.

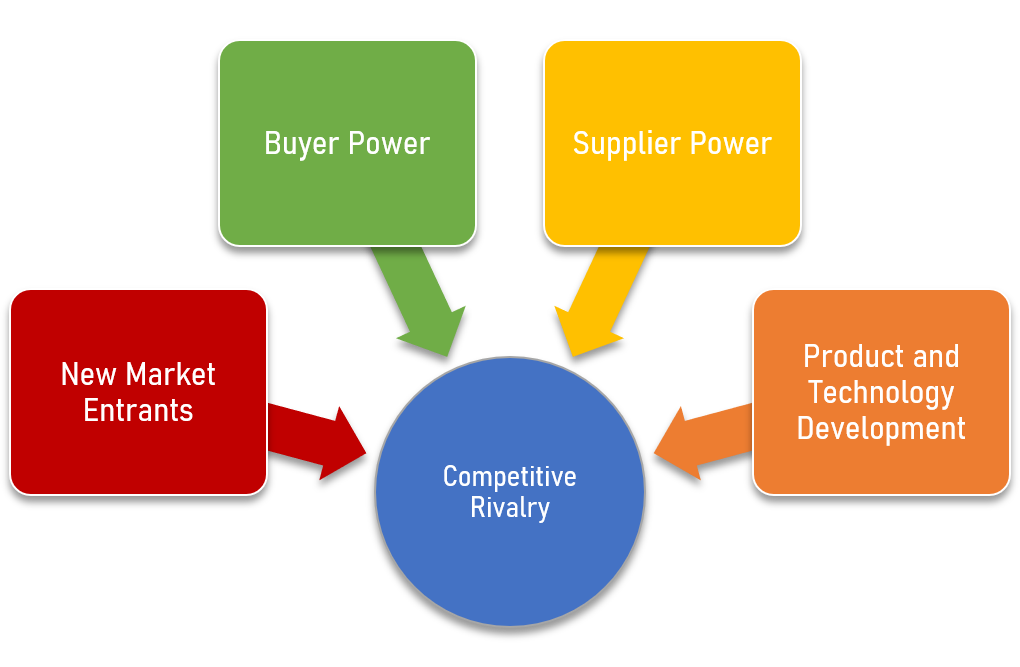

In addition, a well-known framework credited to Dr. Michael Porter, a Harvard University professor, facilitates a rigorous discussion of how the company is positioned to address five key forces that impact value:

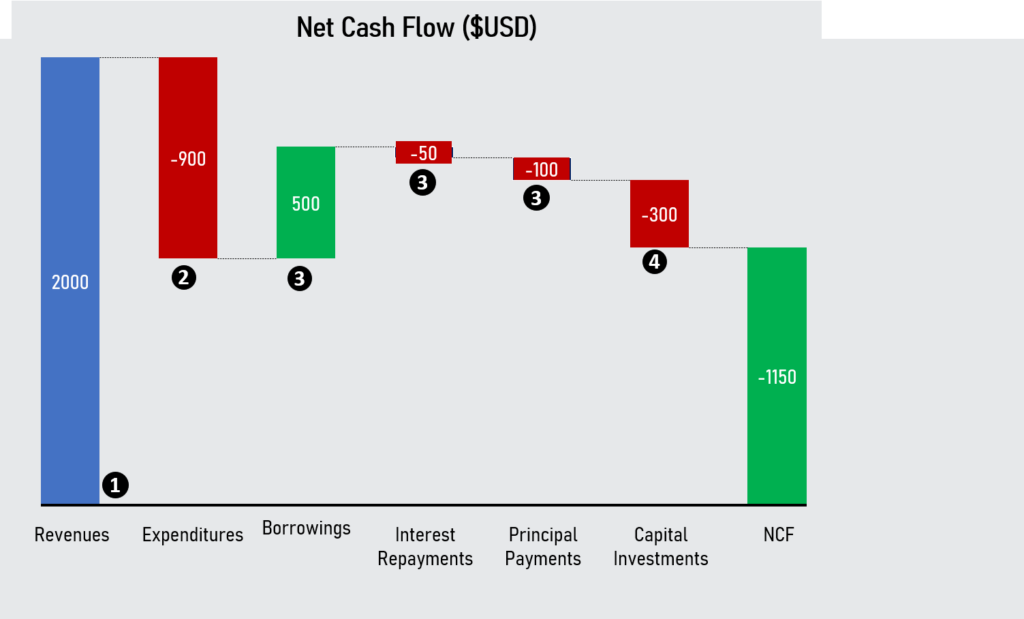

Our team works with owners and managers to understand the international, national, state and local economies as well as the specific industry within which the business operates. After we have analyzed the economy and industry, we delve into the company-specific issues, including how it generates and distributes cash. We dig under the hood and examine each element of the company’s net cash flow to uncover financial and operating inefficiencies to provide insightful guidance to enhance and improve the business’ long-term investment value.

In the example below (net cash flow illustration), we take a detailed and comprehensive view of the company’s operating performance over the past five years and determine where there are weaknesses compared to other comparable competitors within its industry.

- In what quartile within its industry is the business regarding revenue per unit of sale or revenue per square foot of sales space? Is there a reason that explains any inferior performance and what plans can be executed to aggressively improve that performance?

- Are costs in line or best-in-class within the industry? Can we identify and correct any deficiencies?

- What are borrowing costs? Is the borrowing level optimal (not excessive or too limited if borrowing costs are very low)? How is borrowing being used? Does it fit a long-term growth and investment plan?

- Are capital investments achieving a reasonable rate of return for its use based on other competitors.

Developing a comprehensive analysis can help a business grow and weather any economic conditions that may be encountered. Also, this is the kind of check-up recommended prior to financing or at the conclusion of the owner’s business career when preparing for a succession.