What is a business valuation engagement?

A business valuation engagement performed by our team of valuation professionals provides support for a determination or conclusion of value related to a business or intangible asset (for example, patents, trade secrets, copyrights, franchises, trade names, etc.). While it may difficult for a lay person to understand, the value of a business could be different for different purposes. For example, the value for a prospective strategic purchase could be very different than that for gift tax value. The ultimate value of any business will rely on the eventual distribution of cash to the owners at a given point in time. The amount and timing of those distributions of cash will depend on a number of factors, including, the strength of the industry that the business operates, the strength of the company relative to its competitors, and the overall strength of the company’s management.

Why are businesses valued?

Businesses are valued for several reasons. A partial list is provided below:

- Financing of business purchases or expansions through conventional lending or SBA (7a) government backed lending

- Employee stock ownership plans (ESOP) funded by employers to provide incentives

- Estate and gift tax for transfers of business assets to heirs

- Charitable contributions due to donating a portion of a business interest to a charity

- Allocation of purchase price for tax or financial reporting purposes

- Mergers, acquisitions, reorganizations, spinoffs and liquidations

- Buy-sell agreements which allows owners to acquire interests of other owners

- Insurance claims resulting from loss of income due to business interruptions

- Economic damages, including patent infringement, lost business opportunities, breaches of contract, etc.

- Marital dissolution related to community property or equitable distribution states

- Ownership disputes resulting from minority owners feeling they have been negatively impacted by the majority owner

- Incentive stock options allow companies to offer their stock to certain employees for certain prices at certain points of time

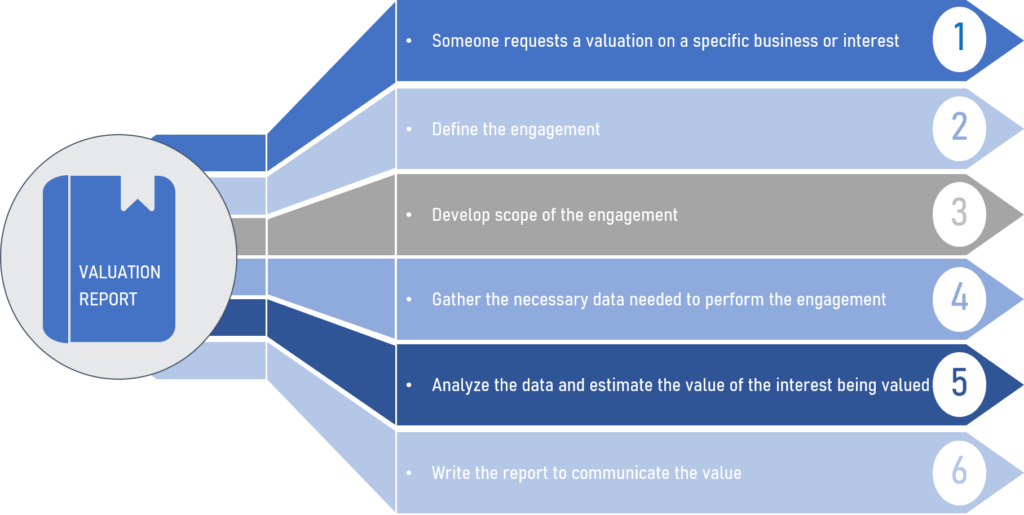

Key components (heavily summarized) of a business valuation engagement:

Who performs valuations?

- Business valuation analysts

- Certified public accountants

- Business brokers

- Investment bankers

- Industry experts

Who provides business and intangible asset valuation standards that are followed by valuation analysts (partial list)?

- American Society of Appraisers (ASA)

- American Institute of Certified Public Accountants (AICPA)

- National Association of Certified Valuation Analysts (NACVA)

- Institute of Business Appraisers (IBA)

- The Appraisal Foundation (AF)

- International Valuation Standards Council (IVSC)

- International Association of Certified Valuation Specialists (IACVS)

- International Mineral Valuation Committee (IMVAL)